Market Integration

Seamless Infrastructure. Real-Time Execution. Connected Financial Systems.

VedaKronos Technologies delivers advanced market integration solutions that unify your trading ecosystem with global liquidity, data, and risk infrastructure. From plug-and-play APIs to deeply embedded microservices, our systems are designed to ensure speed, accuracy, and compliance in every trade execution and data flow.

We empower fintech companies, brokers, and institutional platforms to achieve real-time interoperability across multiple trading venues, asset classes, and technology stacks.

Advanced Trading Terminal

We develop high-performance, multi-asset trading terminals that deliver real-time charting, advanced technical analysis tools, and algorithmic trade execution. Designed for both retail and institutional traders, these terminals are responsive across devices and tightly integrated with backend systems, enabling fast, secure, and intuitive trading experiences.

Customizable layouts, plugin architecture, and support for multi-screen environments ensure traders can tailor the terminal to their strategies and workflows.

Bid

1.0876

Ask

1.0878

Spread

0.2

Daily Δ

+0.15%

BUY

@ 1.0878

SELL

@ 1.0876

Market Connectivity Suite

Our modular market connectivity layer links your platform to global liquidity providers, exchanges, and ECNs. Built for low-latency execution and high system uptime, it supports industry protocols like FIX, REST, and WebSocket to provide uninterrupted access to global markets and seamless trade routing.

Load-balanced infrastructure and smart order routing logic enable superior trade execution and liquidity optimization in volatile market conditions.

Connectivity Dashboard

All Systems Operational

Active Connections

Avg. Latency

Connected Venues

NYSE

FIX 4.4NASDAQ

FIX 4.4LSE

FIX 5.0Binance

WebSocketCoinbase

RESTCME

FIX 4.2Risk-Integrated Bridge System

We engineer smart bridge systems that connect MT4/MT5 and proprietary trading platforms with liquidity providers, while embedding real-time risk management mechanisms. This includes position-level monitoring, trade validation, and order filtering to ensure compliance, reduce slippage, and enhance execution efficiency.

With dynamic risk profiling, configurable limits, and latency-aware filters, the bridge system empowers brokers to operate confidently in complex market environments.

Risk Management Console

Active Risk Filters

Max Position Size

Per client: 10 lots

Slippage Control

Max: 3 pips

Exposure Limit

EURUSD: $5M max

Orders Processed

12,458

vs. last hour

Risk Alerts

3

new alerts

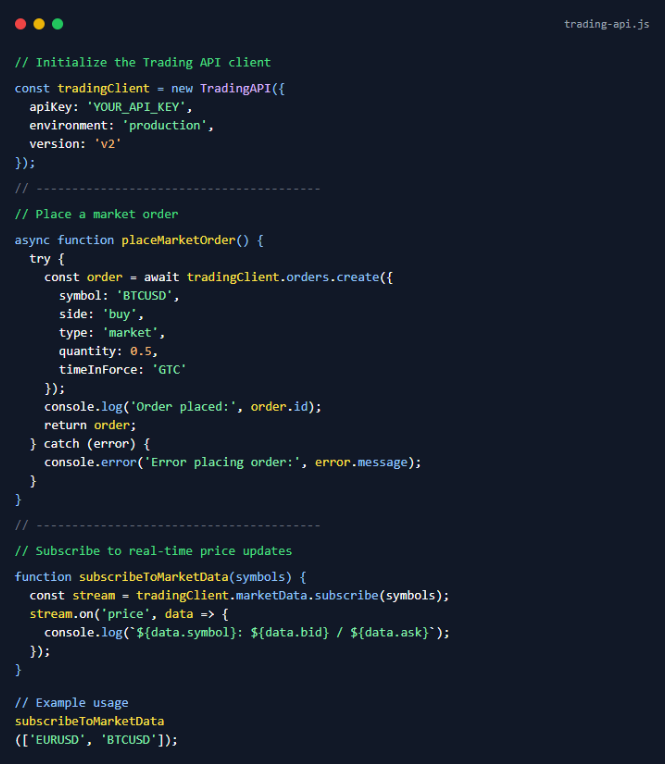

API Integration & Microservices

Our APIs and microservices are designed to be modular, scalable, and secure—facilitating rapid integration of trading engines, KYC modules, payment gateways, and analytics tools. Fully documented and versioned, they help you innovate faster while maintaining system integrity and flexibility.

We support sandbox environments for testing and provide SDKs and Postman collections to accelerate development across your tech stack.

Real-Time Data Feeds

We enable high-frequency data ingestion using secure WebSocket and streaming API technologies. From live market prices and order books to trade events and sentiment signals, our real-time infrastructure ensures your platform is always market-synced with minimal latency and maximum reliability.

Scalable to millions of messages per second, our architecture is designed for low-jitter delivery, enabling precision analytics, alerts, and HFT strategies.

Real-Time Data Monitor

Live

Order Book: BTCUSD

Messages/sec

12,458

Avg. Latency

4.2ms

Recent Trades

Why VedaKronos for Integration?

Ultra-low latency infrastructure

Our optimized network architecture ensures minimal delay between market events and your platform's response, critical for high-frequency trading and real-time decision making.

FIX, REST, WebSocket & custom API support

Connect to any market or service with our comprehensive protocol support, enabling seamless integration with both legacy systems and modern microservices architectures.

Built-in smart routing & risk filters

Protect your business with intelligent order routing and pre-execution risk checks that prevent costly errors while optimizing execution quality across multiple venues.

Modular architecture for easy scaling

Our component-based design allows you to start small and expand as needed, adding new markets, assets, or features without disrupting existing operations.

Tested across FX, crypto, commodities, and equities

Our solutions have been battle-tested across diverse asset classes and market conditions, ensuring reliability regardless of your trading focus or market volatility.